Catch-Up Bookkeeping: Understanding What It Is and How It Works

Check out our helpful guide for deciding when is the right time for your business to invest in hiring a bookkeeper. They also provide ‘audit representation’, offering support and representation during an IRS audit. They can guide you through the audit process, communicate with the IRS on your behalf, and advocate for your interests to ensure a fair outcome. Grab a coffee (or two) and follow these steps to streamline the project.

– Increase your business’s survival odds by 313%

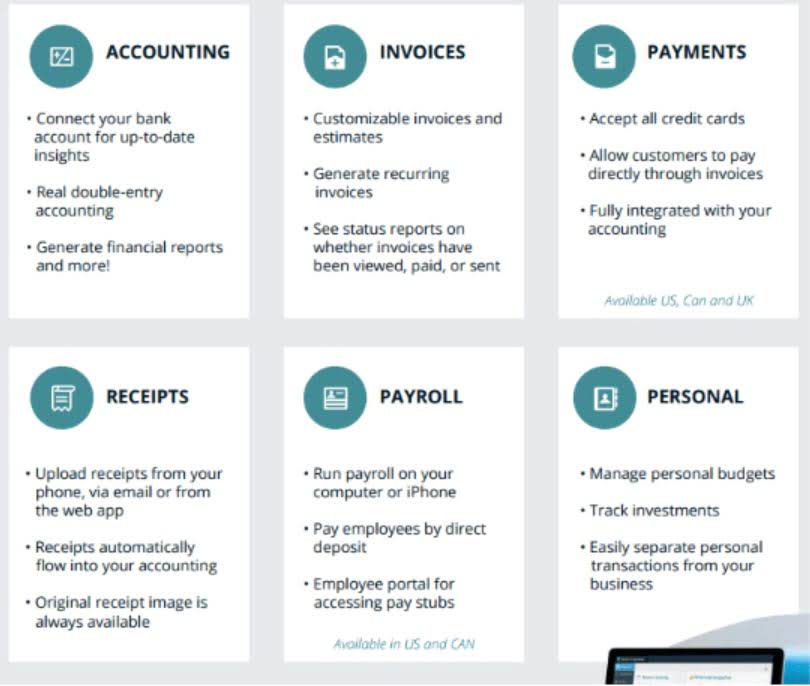

You may need to hire a bookkeeper to reconcile all the digital and physical receipts of expenses, invoices, and other transaction records into your general ledger. These transaction records are essential for accurate bookkeeping and reporting. Catch up bookkeeping services play a vital role in ensuring your business’s financial records are accurate, compliant, and up to date.

Maximizing Your Future: The Top Benefits of Roth IRA Accounts

A bookkeeping service or accountant can help you meet all tax obligations and file your returns correctly and on time. This can help you make informed decisions, improve profitability, and ensure your financial records are accurate and compliant. Catch-up bookkeeping is essential for business owners to update company accounting records, rectify inaccurate financial statements, manage overdue bookkeeping, and ensure better financial control. For small and medium-sized businesses, maintaining accurate financial records is crucial for sustained growth and success.

- The ideal candidate for this role should possess a foundational understanding of accounting principles and practices and familiarity with QBO or Xero accounting software.

- For example, you could create separate categories for office supplies, travel, meals, and advertising.

- You could be months or years behind on your bookkeeping, and catch-up service will help you quickly get your books in order.

- These include bills for business activities that are still currently operating in your business’s closing period to ensure these expenses will appear on your year-end financial statement.

- A good bookkeeper never cuts corners, and they are indispensable to small business owners who want to spend time growing their business, instead of maintaining it.

- Especially if your accountant ends up telling you you’ve been using them incorrectly for the past year.

- Look for potential tax deductions and credits applicable to your business.

What’s the difference between catch up bookkeeping and bookkeeping clean up?

Continuously invest in training and education for your finance team to stay updated on accounting principles, regulations, and best practices. Knowledgeable and skilled staff are essential for maintaining accurate financial records. Reconciling accounts is a fundamental aspect of catch up bookkeeping that ensures the accuracy and integrity of financial records. Maintaining accurate and transparent financial records is essential for preserving the reputation and credibility of businesses.

Step 3: Separate Your Personal and Business Expenses

If you’re not prepared, this can lead to costly mistakes, such as overpaying or underpaying your taxes. You can have it handled in-house by hiring an accounting team so you can work more closely with them. However, this team would need to handle both catch-up work and the bookkeeping and accounting for the current month. It all depends on how long you have ignored your books, and how messy your records are.

Why bookkeeping matters

We’ll dive into the nitty-gritty of your financial records, pinpoint any discrepancies, and bring your books up to speed. Organize all of your receipts and invoices so that they’re easily accessible. We recommend using a cloud-based accounting software to catch up bookkeeping safely store your financial documents. Schedule regular reviews of financial records to identify any discrepancies or anomalies promptly. Set up automated alerts and notifications within your accounting software to flag potential issues or irregularities.

Find out how much cleanup you need with our free Financial Health Score.

This will help you see where your money is going and identify any areas where you may be overspending.And make sure to categorize expenses as soon as they happen! If your answer is yes, it’s time to leverage our Financial Health Score – a powerful and free tool that catches 80% of your bookkeeping errors within just a few minutes. During business growth or transition https://www.bookstime.com/ periods, such as expansion into new markets or changes in ownership, businesses may encounter increased complexities in their financial operations. As the scale and scope of business activities evolve, existing bookkeeping practices may become inadequate, necessitating catch-up bookkeeping to align with the changing needs and demands of the business.

Bookkeeping vs. Accounting: Differences & Examples

Catch up bookkeeping is the solution for businesses that may have slacked on their own bookkeeping. Catch up booking is all about helping you bring those books back on track, catching and correcting any mistakes, and getting you prepared and compliant for tax season. This helps to eliminate errors and ensure that you’re claiming all of the deductions available to your business. Handing over any accounts to your bookkeeper or accountant that aren’t properly reconciled can be costly.

One of the most important aspects of financial transactions is recording them accurately. This involves keeping track of all the money that comes in and out of a business. While you can do catch up bookkeeping yourself, hiring a professional may save you time and money in the long run, ensuring accuracy and reducing the risk of any tax-related issues. Establish an expense tracking system to accurately categorize all of your business expenses. Putting a process in place for reviewing and authorizing expenses can prevent tax filing errors and potential fraudulent activity.